By Amy-Xiaoshi DePaola, AsAmNews intern

In 2018, about 5 million Asian Americans were deemed financially ready to own a home, but almost one million were unable to buy one.

The discrepancy is mainly due to incomplete credit applications and down payment expenses, according to a new report by the Asian Real Estate Association of America (AREAA).

“AAPI tend to be younger, have higher credit scores, and income than the overall population,” said Jaya Day, Fredie Mac’s senior economist of the single-family division, during a Tuesday press call. “But one of the biggest barriers is down payment.”

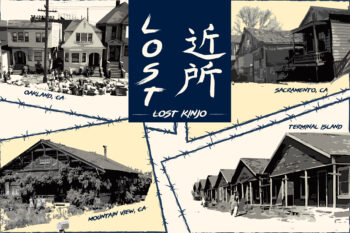

There is still a housing gap in the U.S., with the majority of homeowners being White. Asian immigrants were banned from entering the U.S., with the Housing Act of 1954 displacing communities of color. It wasn’t until over ten years later that the Civil Rights Act of 1964 was expanded to prevent housing discrimination by race and ethnicity.

LATEST STORIES

Japanese Americans make up the majority of homeowners, followed by Vietnamese, Chinese, and Filipino Americans, according to Day.

But the majority of Asian Americans are concentrated in high-cost areas.

“A lot are living in California, Texas, Chicago, and Honolulu,” said Day.

Most purchases – about 114,000 – were in California’s Los Angeles-Long Beach-Anaheim area in 2018. However, the area is not known for affordable housing, with the average price being just over $400,000.

As a result, the high cost leaves many to scrape together enough money for the traditional 20% down payment, a process that can take years.

Asian Americans also tend to avoid using Federal Housing Administration (FHA) loans, said Jim Park, AREAA’s chairman emeritus.

Instead, 92% of Asian Americans rely on “conventional” loans, the highest of any ethnic group, according to the report.

A lack of credit history is also a barrier.

“These are not people with bad credit, just no credit history,” Day said.

The report found that Asian American borrowers tend to be younger, mainly Millennials.

This may factor into why there is a lack of credit, Park said. Young people need to be further educated on how to use credit as a tool.

But, he added, many Asian Americans are immigrants, who tend to be “cash-based.” The reports found that AAPI families preferred cash in order to avoid loan debt.

“We attach to something real, like home ownership, something that can’t be taken away from us,” Park said.

Park and Day suggested that lending institutions look at other factors besides credit, such as rent statements.

But the COVID-19 pandemic may drastically affect home ownership.

The report’s data was compiled before the pandemic, Day said, so the hit to small businesses, many of which are owned by minorities, is unknown and is a “significant concern.”

AsAmNews has Asian America in its heart. We’re an all-volunteer effort of dedicated staff and interns. Check out our new Instagram account. Go to our Twitter feed and Facebook page for more content. Please consider interning, joining our staff, or submitting a story.