By Ed Diokno

Views from The Edge

Oh, where to begin? The Trump tax plan is bad for the country in so many ways its difficult to list them in one posting … but, I’ll try. Bear with me, dear readers:

One of my daughters is a high school teacher in California. Every year in August, she has to buy extra supplies for her students out of her own paycheck. Pencils, paper, etc. – because her cash-strapped school district can’t afford a full-year’s supply for each classroom.

On her tax form, she is allowed to deduct up to $250 for those teaching supplies even though the actual cost is way more than that. It’s a small amount, but at least it’s something. Under the Trump tax plan, that meager deduction will go away.

She lives just down the road from Silicon Valley. One of the high-tech giants that have made its founders billionaires, — under the Trump tax plan — is allowed to deduct pencils, computer paper, markers, all those gourmet lunches we hear so much about, the yoga classes and the grand annual blowouts that the companies throw for their employees.

Doesn’t seem fair, right?

The Trump tax bill, H.R. 1, has already passed the House along party lines and the Senate is working on its own version that it will vote on Nov. 27.

In addition, because she lives in California, my daughter would lose the deduction of California’s state income tax which means a couple thousand dollars will be added to the total that the Feds could tax. This provision would impact those states with high state taxes such as New York, Washington, New Jersey, Hawaii, Illinois where almost half of the nation’s Asian Americans live.

If that’s not enough, the bill rips away critical benefits that help her pay for her masters degree in math college by ending the student loan interest deduction and the Lifetime Learning Credit that helps students afford graduate school. She would be joined by the thousands of Asian Americans who pursue advanced degrees at a rate almost twice as much as the rest of the nation as a whole.

That in a nutshell is only one example of how the tax bill being rushed and pushed through the GOP-dominated Congress before the end of the year just so the Republicans say they accomplished one major piece of legislation.

“These are just some of the ways middle class Americans are asked to pay for corporate tax cuts,” said Rep. Judy Chu, D-CA, chair of the Congressional Asian Pacific American Caucus. “All in the name of trickle down economics, a theory that has been repeatedly tried and shown not to work.”

She’s right. It didn’t work under President Ronald Reagan. It didn’t work under President George W. Bush and it won’t work under Trump. This is why it is important to study and learn from history. In the past that money didn’t trickle down. Under that disproven theory, it provided more money for the CEOs and investors who instead of putting that extra money back into the U.S. economy by creating more jobs, squirreled it away in tax havens around the world.

Don’t believe me? Watch this MSNBC segment showing a room full of CEO’s who are asked who plans to reinvest those tax savings into creating more jobs:

Greed trumps the common good. It’s clear that nothing is going to “trickle down!”

For a couple, deductions will double, but that benefit will be offset because the interest on mortgages, the biggest deduction for most middle-class families, will be eliminated.

Charitable giving will likely go down because those itemized deductions will also go down the tubes. That would spell doom to the nonprofit sector, the safety net, that provide services for the less fortunate, the undocumented, the struggling and those who need a little assistance to get over the economic or cultural hump to become a contributing member of society.

As an attack on the so-called intellectual “elite,” (re: those people who didn’t vote for Trump) the tax plan would tax donations to universities

Despite the flaws in H.1, the bill passed the House, 227 to 205, with 13 Republicans siding with the Democrats. The Republicans who defected mainly came from those states with high state taxes.

Under the guise of tax reform and after repeated failed attempts at repealing the ACA, the GOP is now attempting to attack our health care system through the Senate tax bill, which makes it even worse than H.R. 1. The proposed tax bill comes dangerously close to eliminating critical health and safety net programs that millions of Americans rely on and puts the burden of tax reform on low- and middle- income people by benefiting the top 1% and wealthy corporations.

The Senate tax bill proposes to repeal the ACA’s individual mandate, which the Congressional Budget Office (CBO) estimates would cause 13 million people to lose their health insurance, a 10% increase in insurance premiums, and five million fewer people to enroll in Medicaid. In addition, the tax bill includes the potential to slash Medicare by $473 billion, cut Medicaid by over $1 trillion, and increase the federal deficit to $1.5 trillion.

These cuts would impact many Americans, including over 850,000 Asian Americans, Native Hawaiians, and Pacific Islanders (AANHPIs) who have benefited from the ACA nationally. Prior to the ACA, about 20% of Asian Americans were uninsured, but after ACA implementation, the uninsured rate dropped dramatically to 8% in 2015.

That “me, first” attitude is – well – unpatriotic.

To satisfy critics who say the tax plan would benefit the very rich, the House decided to keep the 39.6% tax rate for millionaires’ salaries and wages. That sounds good until you realize that the 1-percenters earn most of their money through investments and capital gains; income that has a lower rate that tops out at just 23.8%.

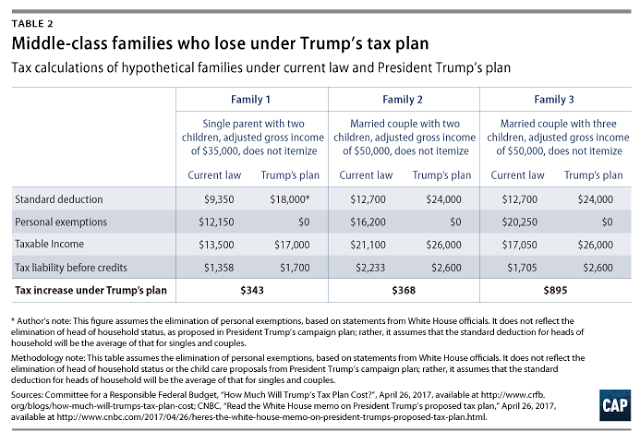

The thing Republicans fail to mention is that the tax cuts for the middle class will expire in a few years and by 2028, millions of Americans will actually be paying more taxes than they are paying now.

And here’s the kicker: The tax cuts for the super wealthy will be permanent.

With all the tax cuts proposed by the GOP, where will the money come from to run the country, to modernize out infrastructure, to provide for our defense, to enforce our laws, to educate the generations to come?

“It’s doubly outrageous that while they’re doling out extra yachts and private jets to the elite, their budgets make cuts to Medicaid, Medicare, Social Security, and public education, further lowering the standard of living for working families,” said Frank Clemente, executive director of the nonpartisan Americans for Tax Fairness. “That’s no tax plan, that’s a tax scam.”

WARNING! Angry screed coming:

The same people who take advantage of living in a free society, who depend on an educated work force, who use the country’s infrastructure to move their goods around, who depend on a safe environment to allow them to do business; who want healthy and happy employees working for them by paying them decent salaries so they can afford to buy their own modest homes, who educate their children in our public schools, and who can afford health care; those same 1-percenters have the nerve to take away the tax dollars that would help pay for all that so they can fly away from the U.S. in their private corporate jets to their second or third homes in Switzerland or the Caribbean or sail around in their luxury yachts and send their kids to private schools.

The 1-percenters — the corporate CEOs who move our jobs overseas (to save a buck for their investors) and the Wall Street traders detached from Main Street. The investors and the traders who play computer games on the real-world sweat of workers lower down on the economic ladder — say to hell to the rest of us. In their quest to line their own wallets, they actually believe they accumulated their wealth on their own. They forget the factory workers who produce the products they sell, the farmworkers who harvest their produce or raise their livestock; the military men and women who fight their wars; the construction workers who build their offices and maintain our roads and bridges, the medical personnel who take care of our health needs, and … the teachers who teach the children of their employees, who will become the educated, high-skill work force that our country needs for the 21st century.

They don’t see the middle class struggling to make the mortgage, seeking a health plan they can afford to pay for their kids’ braces or fix their eyesight, or trying to save for their children’s college education. They only see the bottom line – profits and losses.

What is certain, though, is that helping the middle class is not the real goal of the Trump tax plans. The so-called tax reform’s real goals is cutting taxes for corporations and the super wealthy, and whatever sacrifices must be made to make the math work will be borne by the very people Republicans claim to be helping.

The thing is, with such a major piece of legislation that is going to impact us for years to come, why are the Republicans trying to rush this through? Why did they write this up behind closed doors. Shouldn’t there be a proper examination with public hearings and input from economists?

Remember my daughter who had to buy school supplies for her students? She’ll probably continue to do that because that’s just the person she is. But, she’ll have to cut her expenses elsewhere, fewer movies, fewer restaurants, and such, which, in turn, will have a ripple effect throughout the whole economy with theater workers losing their jobs, restaurants closing, food suppliers going out of business, etc. This is the reality of a trickle down economy.

AsAmNews has Asian America in its heart. We’re an all-volunteer effort of dedicated staff and interns. You can show your support by liking our Facebook page at www.facebook.com/asamnews, following us on Twitter, sharing our stories, interning or joining our staff.