The AARP has issued an important alert for anyone who cares for an aging senior and for those under their care.

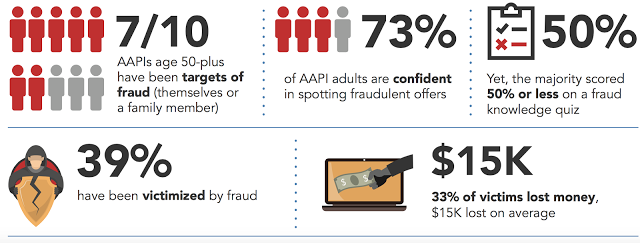

Nearly 40% of Asian Americans and Pacific Islanders (AAPI) age 50 and older report that they or their family members have been victimized by fraud schemes, according to the recent fraud survey from AARP. The survey reports that an even greater number, over 70%, have been targeted by scammers.

Additionally, one-third of victims lost $15,000 on average. Non-financial costs are even more widespread, with most fraud victims (72 percent) experiencing some sort of emotional, physical or mental health impact, including anger, stress and anxiety, difficulty sleeping and shame.

“Everyone in the AAPI community is at risk for fraud,” said Daphne Kwok, AARP Vice President of Multicultural Leadership, Asian American and Pacific Islander Audience Strategy. “This survey underscores the need to raise awareness around fraud and scams in order to protect against financial and non-financial loss. AARP seeks to help the AAPI community protect their families and their hard-earned savings.”

Awareness and education are major factors in avoiding fraud, but many AAPIs age 50 and older may be overconfident in their ability to spot common scams. In the survey, nearly three of four participants (73 percent) were confident they could spot a fraudulent offer, yet the majority (71 percent) failed a general fraud knowledge quiz of six questions, unable to correctly answer more than half of the questions.

Some of the most common types of fraud targeting AAPIs age 50 and older include:

- Foreign lottery scams (36 percent)

- Crisis-related charitable donations (33 percent)

- Tech support scammers offering virus removal (32 percent)

- IRS imposter calls to collect back taxes (24 percent)

- Phishing emails (20 percent)

- Seventy-two percent (72%) of AAPIs age 50-plus and their families have been targets of fraud.

- Thirty-nine percent (39%) of AAPIs age 50-plus and their families have been victims of fraud.

- One in three victims of fraud did not talk to anyone about the fraudulent incident.

- Thirty-three percent (33%) of victims lost money, costing them $15,000 on average.

- Seventy-two percent (72%) of fraud victims experienced an emotional, mental or physical outcome.

AARP offers advice on dealing with the non-financial impact of fraud, including:

Understand you are not alone and that it’s not unusual to experience feelings of anger, shame and embarrassment.

Family members can also support a victim of fraud by:

- Listening with an empathetic ear to your loved one.

- Asking questions to better understand the situation and context in which the fraud occurred.

- Keeping lines of communication open. Remember to focus frustration and anger on the scam and the perpetrator — not the victim.

- Listening for clues of continued participation, such as: “I’m going to win money” or “the nice man on the phone said.”

- Reading the free AARP Fraud Prevention Handbook and discussing it with your family members (see below for details).

AARP urges people who have lost money to a scammer to report it immediately to the consumer credit bureaus (directions available on their websites) and credit card companies if a charge card was involved. Victims should also report scams to the Federal Trade Commission and their state Attorney General’s office.

(For more information, visit aarp.org/AAPIfraudsurvey. For detailed tips on avoiding fraud, download the free AARP Fraud Prevention Handbook in English and Chinese.)

AsAmNews has Asian America in its heart. We’re an all-volunteer effort of dedicated staff and interns. Check out our Facebook page and our Twitter feed, Please consider interning, joining our staff or submitting a story for consideration.